Vietnam’s retail market has a scale of more than US$142 billion, 16 per cent of which comes from e-commerce. This scale is forecast to increase to $350 billion, or nearly 2.5 times higher, by 2025.

Vietnam, with a population of nearly 100 million people, is considered a potential investment market for famous retailers around the world; therefore, many foreign retailers have enhanced their investments.

According to the Ministry of Industry and Trade, Vietnam’s retail market has a scale of more than US$142 billion, 16 per cent of which comes from e-commerce. This scale is forecast to increase to $350 billion, or nearly 2.5 times higher, by 2025.

The retail based on e-commerce platforms is also growing at an exponential rate. E-commerce businesses in Vietnam gained a revenue of $14 billion by 2022, and the revenue is expected to reach $32 billion by 2025.

These figures show the huge potential of Vietnam’s retail market for enterprises at home and abroad.

A supermarket is still considered an attractive retail option in Vietnam, with diverse products, a seamless customer experience, and guaranteed product quality.

Data from Euromonitor shows that supermarket revenue in 2023 is estimated to reach about VNĐ110 trillion ($4.5 billion), an increase of 8.8 per cent over the previous year.

These figures confirm a significant change in consumer shopping behaviour.

Vietnam has witnessed excitement in the domestic retail market from the first months of the year until now, when a series of big brands in the foreign retail industry has announced an increase in investment capital to this market.

Among them, MUJI – a famous retail brand for lifestyle, leather goods, and office furniture from Japan, has expanded its retail system in Hà Nội and HCM City to 11 stores.

Meanwhile, Uniqlo – another big brand from Japan, also opened its 19th store in Hà Nội, which is the fourth new store in the first half of 2023.

Additionally, in recent years, many large Thai enterprises have also evaluated Vietnam’s retail market as one of the most potential and attractive markets.

Therefore, Central Retail Group, a giant in Thailand’s retail industry, has announced a schedule to increase investment capital in Vietnam to $1.45 billion (VNĐ35 trillion) in the period 2023 – 2027, along with the goal of doubling the number of stores and supermarkets in Vietnam to 600 in 57 out of 63 provinces and cities. This is considered the largest investment ever announced by Central Retail.

To implement those goals, this year, the company has spent about VNĐ4.1 trillion in the Vietnam market, focusing on developing essential foods businesses, stabilising prices, and restructuring electronic stores.

Central Retail also aims to become the largest multi-channel retailer in the food industry, and the second largest investor in the shopping centre segment in Vietnam’s real estate market by 2027.

Meanwhile, local retailers still dominate the domestic market, accounting for 70 – 80 per cent of total retail sales points nationwide. There are big brands with thousands of sales points such as WinMart, Co.op Mart, and Bách Hóa Xanh.

However, foreign retailers’ investment in the Vietnam market also puts certain pressure on domestic retailers. This situation urges domestic businesses to find ways to compete with foreign rivals.

In the past few years, Vietnamese businesses expanded their retail market share strongly in the segment of supermarkets and convenience stores.

Of which, in mid-2018, Saigon Co.op acquired the entire retail system of Auchan (France) in Vietnam. In 2019, Singapore’s Shop&Go also sold its business in Việt Nam to VinCommerce.

Last year, THISO International Commerce and Services Corporation (THISO), a subsidiary of THACO Group, completed the acquisition of South Korea’s Emart Inc’s business in Vietnam.

Along with implementing the merger and acquisition (M&A) activities with foreign brands in Vietnam, many domestic retailers have also expanded their retail systems in the domestic market.

Notably, Vingroup’s Vincom Retail system owns more than 80 shopping centres nationwide. The WinMart and WinMart+ retail chains, with more than 3,500 convenience stores, are constantly opening new sales points.

Although the market is very competitive, economic experts still believe that Vietnamese retail businesses will have a solid foothold in the domestic retail market due to the advantages of understanding Vietnamese consumers, implementing digital transformation, and restructuring human resources.

To maintain their market shares, expert Vũ Vinh Phú said that Vietnam companies need to improve in all aspects, from training professional human resources to building modern infrastructure, meeting the needs of the digital age to continue development in the retail sector.

Retail enterprises must always link to producers of Vietnamese goods, especially agricultural and food products, to ensure stability for the input of the distribution system.

Also, according to Phú, the domestic retailers are now mostly small and medium-sized enterprises, and there is no large retail group. Therefore, a joint venture with foreign retailers is necessary.

The newly published report of Rồng Việt Securities (VDSC) predicts that the retail industry will slightly recover in the second half of 2023 and improve more clearly in 2024. Market leaders will continue to grow their market share after the slowdown.

Retailers will increasingly target the Northern regions, where modern trade channels have not yet gained substantial traction. However, they will first focus on consolidating their market share in the South before tapping into these untapped markets. Urbanisation will also play a role in shaping consumer behaviour, allowing for the expansion of modern retail networks in Tier 2 and 3 areas, according to the report.

To restore consumer demand in the last months of the year, localities are ready with promotion programmes. In Hanoi, this year’s promotion programmes last longer and focus on each kind of goods according to each month’s theme.

Trần Thị Lan Phương, acting director of the Hà Nội Department of Industry and Trade, said the department has received 21,000 trade promotion programmes from 4,000 businesses registered to participate, double last year’s number, and continues to add more.

For example, in November, the “Promotion Month” event is deployed in the city with participants being enterprises, production, and business facilities of all economic sectors.

Also in November, the event “Hanoi Midnight Sale 2023″ will attract about 200 businesses, shopping centres, supermarkets, convenience store chains, production, and business facilities.

The Ministry of Industry and Trade also said that from now until the end of the year, the ministry will direct the people’s committees of cities and the departments of industry and trade to promote the consumption stimulus programme associated with stabilising the market of goods for the Lunar New Year in 2024, and organising the cultural and tourism events to both attract tourism and increase purchasing power.

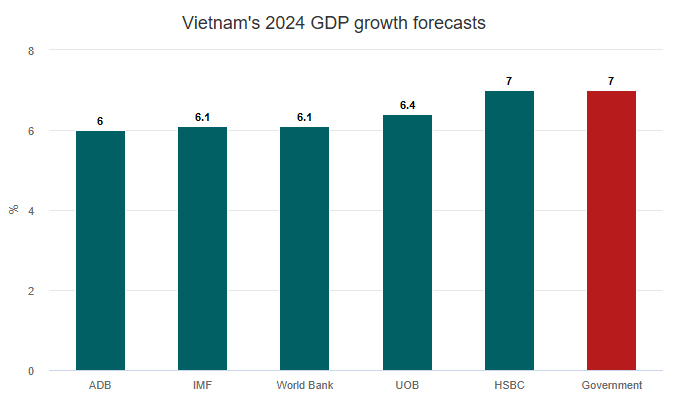

Businesses also said that many policies of the Government, such as reducing value-added tax and increasing the base salary from July 1, are expected to increase consumers’ purchasing power, contributing to the recovery of GDP in 2023.

The experts also believe that the State’s efforts to promote consumption and the businesses’ diverse business strategies are helping the business of the retail industry be better in the last months of the year.

Source: Vietnamnews

30/10/2023