Vietnam bid farewell to 2023 on an upbeat note as the country spent the year experiencing positive signals that could help fulfill its ambitious goal of developing the semiconductor industry.

![]()

Vietnamese Prime Minister Pham Minh Chinh (C) meets with Vietnamese employees at Synopsys in the U.S. Photo: Nhat Bac / Tuoi Tre

Perhaps the most notable of these signals was that ‘semiconductor’ and ‘chip’ were the most-discussed keywords relating to the local economy in 2023.

Expanding international cooperation

With its aim at facilitating international economic integration and engaging more deeply in the global supply chain, Vietnam has made great efforts to attract investment in the semiconductor and chip-making industries, as well as collaborated with countries taking the lead in the fields.

The Southeast Asian country elevated its bilateral ties with the U.S. to comprehensive strategic partnership during U.S. President Joe Biden’s state visit to Vietnam in September last year, paving the way for more cooperative opportunities between Vietnam and top chip makers in the U.S.

According to a report on the information and communications technologies (ICT) industry released by the Ministry of Information and Communications in May last year, Vietnam ranked third globally in terms of the outbound sales of chips to the U.S. market, just after Malaysia and Taiwan.

Vietnam was among the top countries including Thailand, India, and Cambodia which hiked up chip exports to the U.S. market.

Foreign investors, particularly U.S chipmaker Intel, made tremendous contributions to such export growth.

The U.S. Department of State is partnering with the Vietnamese government to explore opportunities to develop and diversify the global semiconductor ecosystem under the International Technology Security and Innovation (ITSI) Fund established by the CHIPS and Science Act of 2022.

U.S. President Joe Biden in August 2022 signed the CHIPS Act, a U.S. federal statute enacted by the 117th U.S. Congress that provides billions of dollars in new funding to boost domestic research and manufacturing of semiconductors in the U.S., according to the U.S. State Department.

This partnership with Vietnam will help create a more resilient, secure, and sustainable global semiconductor value chain, the U.S. State Department said in a press release last September.

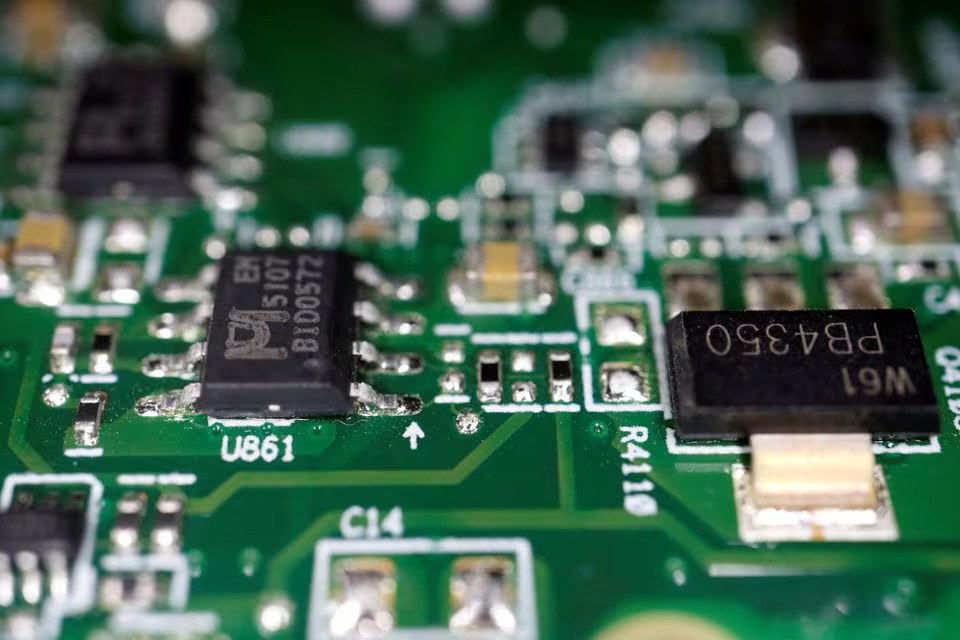

Semiconductor chips are seen on a printed circuit board in this illustration picture taken February 17, 2023. Photo: Reuters

Products ranging from vehicles to medical devices increasingly rely on semiconductors, making these tiny devices the building blocks of today’s economy.

According to the U.S., Vietnam shows promise as a partner in ensuring the semiconductor supply chain is diverse and resilient.

“By building on Vietnam’s existing strengths in assembly, testing, and packaging. This collaboration strives to identify new opportunities that attract industry investments and expand the technical workforces in both countries,” the U.S. State Department said.

Aside from the U.S., the Netherlands – another powerhouse in the semiconductor industry – expressed interest in collaborating with Vietnam in the field.

The management authority of the Saigon Hi-Tech Park in Ho Chi Minh City granted an investment registration certificate to BE Semiconductor Industries N.V. (Besi), a Dutch maker of chip equipment, on November 2, 2023.

The certificate will allow Besi to build a manufacturing facility for semiconductor equipment components in the Saigon Hi-Tech Park in 2025. The Dutch firm expects to install machinery and equipment at the factory in 2024 before putting the facility into operation in 2025.

A ceremony held to celebrate the awarding of the investment certificate was organized during a two-day official visit to Vietnam by Dutch Prime Minister Mark Rutte, who led a delegation of nearly 30 Dutch hi-tech firms that came to Vietnam to mainly explore cooperative opportunities in the semiconductor industry.

During the visit, which took place from November 1 to 2 last year, PM Rutte and his Vietnamese counterpart Pham Minh Chinh agreed to fully exploit cooperation opportunities in hi-tech, semiconductor equipment production, telecommunications ecosystem development, digital transformation, and human resources development.

Aside from Intel, many other multinational corporations, including Samsung, Qualcomm, Texas Instruments, SK Hynix, Hayward Quartz Technology, Synopsys and NXP Semiconductors have also channeled their investments into Vietnam’s semiconductor industry.

![]()

U.S. chipmaker Intel’s plant at the Saigon Hi-Tech Park in Ho Chi Minh City. Photo: Tuoi Tre

More challenges await

Semiconductor chips are at the heart of the global economy and are widely considered as indispensable to the modern digital world.

Although Vietnam has attracted investment from a considerable number of top global tech firms, it is still primarily considered to be a destination for packaging, assembling, and testing chips. As such, the country must seek out measures to elevate its position in the global semiconductor supply chain in the future.

Reuters reported in late October last year that Vietnam was holding talks with chips companies with the aim of boosting investment in the country and possibly building its first chipmaking plant.

However, these plans may not come to fruition given that Vietnam is in heavy competition with other countries to attract investment in the semiconductor industry. As such, Vietnam may need to make changes to its overall business climate if it hopes to make a bigger entrance into the industry.

Stephen Olson, a trade expert at the Hinrich Foundation in Hong Kong, who monitors the developments of the global semiconductor supply chain, told Tuoi Tre (Youth) newspaper that the upgrading of ties with the U.S. will not be a game-changer for Vietnam and was merely a symbolic gesture to signal U.S. commitment to the region without making any concrete commitments.

“The development of a semiconductor industry depends on corporate decisions rather than government proclamations,” Olson said.

![]()

Inside U.S. chipmaker Intel’s plant at the Saigon Hi-Tech Park in Ho Chi Minh City. Photo: Quang Minh / Tuoi Tre

In an interview with Tuoi Tre, Alicia Garcia Herrero, chief economist for Asia-Pacific at French investment bank Natixis, said that Vietnam will need time to compete with other countries in both Southeast Asia and Europe.

She added that Malaysia and Singapore, for instance, have more human resources than Vietnam, and Poland is also a strong competitor since it has quite a lot of engineers.

In mid-2023, U.S. chipmaker Intel, whose largest semiconductor packaging and testing plant worldwide is located in Vietnam, announced a plan to invest up to US$4.6 billion in a new semiconductor assembly and test facility in Poland.

Despite multiple challenges waiting ahead, observers remained sanguine about a bright outlook of the semiconductor industry in Vietnam.

According to Olson, the fact that Vietnam was able to capture so much of the production that has moved out of China in recent years is a strong vote of confidence in Vietnam’s human and other resources, as well as its overall attractiveness as a production platform.

Experts also underlined the need for Vietnam to prepare proper infrastructure and well-trained human resources in order to join a fierce and prolonged competition to engage in the global semiconductor supply chain.

Commenting on Vietnam’s ambitious goal of building its first chipmaking plant, or “fab,” Olson elaborated that this road could be long and difficult as established chip makers have a huge head start and the barriers to entry are high.

“The costs associated with getting this industry up and running are staggering and it will take years before any new facilities are ready to come online. And that assumes that a sufficient skilled workforce can be found in Vietnam.

“TSMC is already delaying its plans for the U.S. in part due to questions over the availability of skilled workers,” Olson said.

Taiwan Semiconductor Manufacturing Co. Ltd (TSMC) is the world’s largest contract chipmaker and a major Apple Inc and Nvidia supplier.

“Nothing can be done overnight. Improving the educational system and access to education will be critical in order to ensure a skilled workforce. Learning as much as possible from world-class companies already operating in Vietnam is also key. This includes both technological expertise as well as managerial know-how. The government needs to do everything in its power to ensure that rules and regulations are simple and clear, with a minimum of red tape,” Olson added.

In related news, during PM Chinh’s visit to the U.S. in September last year, Synopsys, an American electronic design automation company, and the Vietnam National Innovation Center (NIC), under Vietnam’s Ministry of Planning and Investment, signed a cooperative agreement to develop a workforce capable of integrated circuit design.

As per the deal, Synopsys will support NIC in opening a chip design incubation hub at the Hoa Lac Hi-Tech Park in Hanoi, helping promote the capacity of integrated circuit design and commercialize products quickly.

Synopsys will also join hands with the Authority of Information and Communications Technology Industry, under Vietnam’s Ministry of Information and Communications, to establish a semiconductor research institute in Vietnam.

Further, Cadence Design Systems, an American computational software multinational, Intel, and Arizona State University pledged to help Vietnam strengthen its workforce in technology and ramp up the capacity of chip design.

Hong Ngan – Nhat Dang (Source: tuoitrenews.vn)