The International Monetary Fund pegs Vietnam’s economic growth at nearly 6% this year, driven by exports, foreign direct investment, and policy support.

Vietnam’s recovery began in late 2023, fueled by a rebound in exports, tourism, and appropriately expansionary fiscal and monetary policy support, said Paulo Medas – deputy division chief in the IMF’s Fiscal Affairs Department – in a press release Wednesday after a meeting with government representatives.

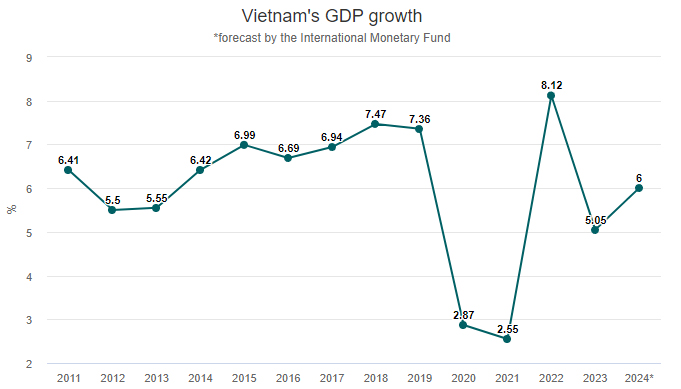

Last year Vietnam’s GDP expanded by 5.05%.

Inflation picked up in the first quarter of 2024, driven partly by rising food prices, though core inflation remained relatively low and stable, Medas said.

“Economic growth is projected to recover to close to 6% in 2024, supported by continued strong external demand, resilient foreign direct investment, and accommodative policies.”

Domestic demand growth is expected to remain subdued as corporates navigate through high debt levels while the real estate sector will only fully recover over the medium term, Medas said.

Inflation is expected to hover around the central bank’s target of 4-4.5% this year, he added. But the IMF also anticipates high risks for Vietnam in the remaining months.

Exports, a key driver for Vietnam’s economy, could weaken if global growth disappoints, global geopolitical tensions persist, or trade disputes intensify, Medas said.

Domestically, persistent weakness in the real estate sector and corporate bond market could weigh more than expected on banks’ ability to expand credit and hurt economic growth and undermine financial stability, he added.

Inflation remains contained, but the central bank should stand ready to tighten monetary policy if upward price pressures were to intensify, he said.

Policies should continue to focus on improving financial stability, which would require strengthening asset quality and avoid excessive, low quality, credit growth, he added.

Medas said that Vietnam needs a new wave of reforms to sustain high growth.

They include increasing productivity, further investing in human and physical capital, and incentivizing private investment in renewable energy, he said. “Efforts to reduce legal uncertainty and allow for swifter decision making by public officials would also foster a more business-friendly environment”.

In April, Standard Chartered Bank revised its growth forecast for Vietnam down from 6.7% to 6%. The Asian Development Bank also peg’s the country’s growth at 6%.

Dat Nguyen (Source: e.vnexpress.net)