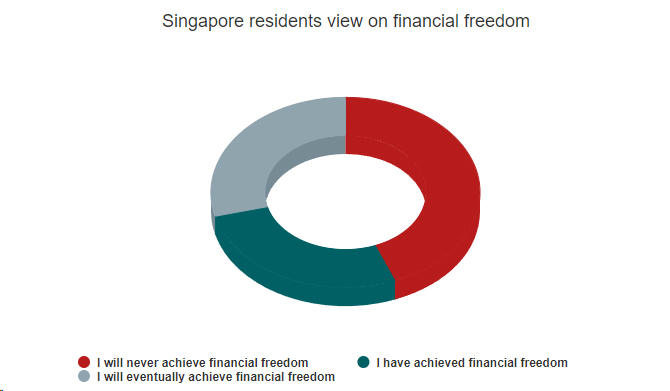

Around 44% of Singapore residents believe they will never achieve financial freedom, partly due to insufficient income and debts, a survey has found.

29% say they will be able to achieve financial freedom eventually, while 27% say they have achieved it, according to a recent survey by insurer Singlife.

Respondents on average say they need to save SGD612,000 (US$468,000) to be considered financially free, up 8% from last year.

This means that people who earn median income of US$15,500 will need 30 years to accumulate enough savings to feel financially free. Last year the figure was 27 years.

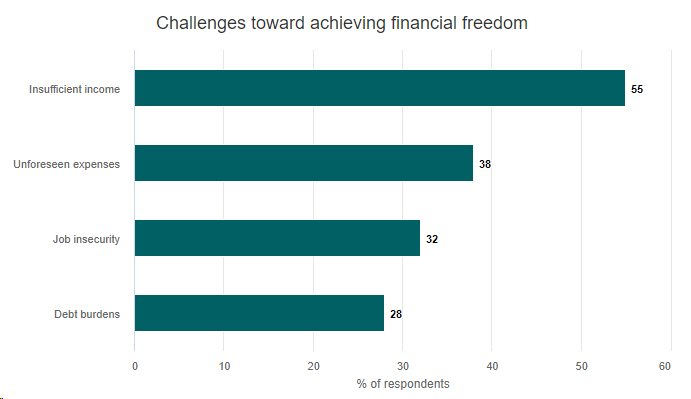

Main barriers to financial freedom are insufficient income, according to 53% of respondents, and unforeseen expenses (38%).

Other challenges are job insecurity (32%), and debt repayment burdens (28%).

This year’s survey shows a dip in sentiments towards attaining financial freedom, with an average score of 58 out of 100, down from 60 in 2023.

But more than half of respondents (55%) say they know how to achieve financial freedom, up from 49% last year.

“This year’s Financial Freedom Index shows that consumers feel an increasing difficulty in achieving financial freedom,” said Debra Soon, Singlife Group head of brand, communications, marketing and experience.

The survey also found that four in five consumers aim to retire by 65 and they will need nearly US$2,200 a month for living expenses.

Participants believe that having children will strongly affect their retirement plan.

Over 40% say having a child will delay their retirement age and ability to achieve financial freedom by an average of 14 to 15 years.

This year’s survey was conducted between April and June among 3,000 Singaporeans and permanent residents aged 18 to 65. Those in the 35- to 44-year-old age group find it most difficult to attain financial freedom.

Dat Nguyen (Source: e.vnexpress.net)