The U.S. dollar fell against the Vietnamese dong Thursday morning while analysts expect its weakness to stall in upcoming months.

Four thousand U.S. dollars are counted out by a banker counting currency at a bank in Westminster, Colorado Nov. 3, 2009. Photo by Reuters

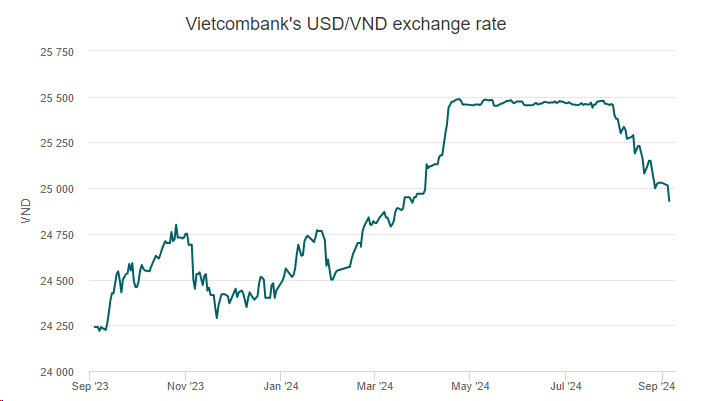

Vietcombank sold the greenback 0.34% lower at VND24,930.

The State Bank of Vietnam brought its reference rate down 0.03% to VND24,222.

The dollar has risen 2% against the dong since the beginning of the year.

Recent U.S. dollar weakness will stall in the coming three months despite financial market traders ramping up bets for Federal Reserve interest rate cuts, according to a majority of foreign exchange strategists surveyed by Reuters, Reuters reported.

The dollar index was at 101.33 at the time of publishing, down 0.03% for the day.

After surging about 5% against a basket of major currencies by midyear, the greenback lost almost all its gains as interest rate futures started pricing in about 100 basis points of Fed easing this year, nearly double June’s expectations.

The euro was forecast to fall only about 0.5%, from around $1.11 currently to $1.10 by end-November, according to median forecasts in the Reuters Aug. 30-Sept. 4 of 76 FX strategists.

It was then predicted to only rise back to $1.11 by end-February and to $1.12 in a year, suggesting limited gains for the common currency.

“We think recent dollar weakness was overdone. Yes, the economy isn’t great, but apart from maybe the unemployment rate, there are very few indicators that point to a recession. Most of them point to sluggish, and we don’t think the Fed will do 50 on sluggish,” said Steve Englander, global head of G10 FX research at Standard Chartered.

Dat Nguyen (Source: e.vnexpress.net)