Vietnam’s economy is likely to have similar impacts whether it is Donald Trump or Kamala Harris winning the U.S. presidency, though the former could make markets volatile, analysts said.

The outcome of the presidential elections, set to take place on Tuesday, is too close to call, recent polls show.

But according to Michael Kokalari, director of macroeconomic analysis and market research at investment company VinaCapital, who wins is unlikely to have much bearing on Vietnam.

Nguyen The Minh, head of research and development at Yuanta Securities, said both candidates are committed to economic growth despite taking different approaches.

Harris has proposed economic stimulation through modest improvements such as increasing tax incentives for families with children, raising the minimum wage, building more affordable housing, promoting small business loans and bringing manufacturing jobs back to the U.S. through incentives.

Trump’s proposals are more aggressive and protectionist, including high import tariffs but reducing taxes for businesses and residents.

Democratic presidential candidate Vice President Kamala Harris (L) and Republican presidential candidate former President Donald Trump. Photo by AP

Kokalari said in a note sent to investors in early September that the Democrats’ approach, which includes subsidizing the development of domestic industries, faces the problems of high manufacturing costs and a low number of skilled manufacturing workers in the U.S.

So taking production back to the U.S. “is not likely to be a serious threat to the types of products made in Vietnam,” he said.

Trump proposes tariffs of 60% on imports from China and 10-20% for other countries as against the average of 2% now imposed on non-agricultural imports.

Most economists have panned this proposal, and Kokalari predicted that Trump might focus on devaluing the dollar to bring back manufacturing jobs instead of hiking tariffs.

Containers for export seen at the Tan Vu Terminal in Hai Phong City, July 2023. Photo by VnExpress/Giang Huy

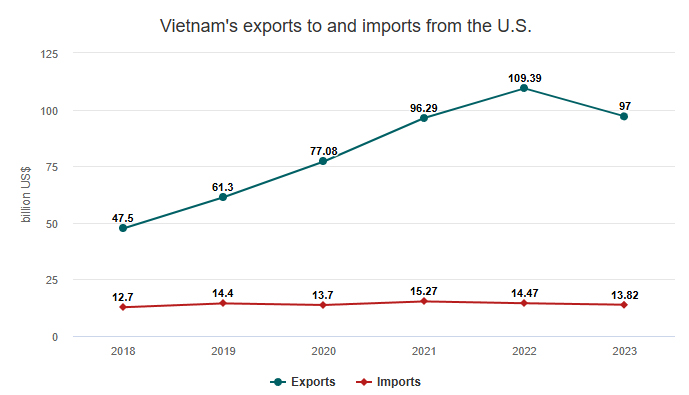

Vietnam stands to benefit from either a weaker dollar or higher tariffs, analysts predicted. Minh said higher tariffs on Chinese goods could shift production to other countries, including Vietnam.

Kokalari said Vietnam’s trade is unlikely to be affected since a weaker dollar would boost exports to countries other than the U.S. while a blanket 10-20% tariff would not affect Vietnam’s competitiveness.

Reports from Standard Chartered and other organizations said higher tariffs specifically aimed at Chinese imports could help Vietnam and Mexico gain an edge in exports to the U.S.

But credit rating agency Fitch had warned in a report October that a second term for Trump could negatively impact Asian economies with huge exports to the U.S., especially China, South Korea and Vietnam.

The three countries might see their real GDP decrease by at least 1% from current forecasts as a result, it said.

According to Minh, the financial and stock markets will see a more notable difference between Harris and Trump’s presidency.

They would see less volatility from Harris’ measured changes as opposed to Trump’s more aggressive policies, he thought.

Commenting on the U.S.-China trade war, American newspaper The Washington Post reported that Trump relied more on his own intuition and analysis rather than on advice from his aides.

Analysts are also concerned that Trump could exert more control over the Federal Reserve if he returns to office.

Maurice Obstfeld, former chief economist of the International Monetary Fund, told CNN: “If you move the Fed to some sort of political control, that is going to really change the rules of global finance.”

Minh said: “If we (at Yuanta) are to forecast market volatility in the short term, former President Donald Trump is certainly a name that investors should be cautious about.”

Financial markets could be in for a shock as policies become more unpredictable, he added.

Minh Son (Source: e.vnexpress.net)