When he became an engineer for leading semiconductor company Renesas, Tran Dac Khoa did not expect to wait for five years to design his first chip.

The job, listed in a daily newspaper, came with a short description about the Japanese-owned company, one of the world’s top 10 chipmakers.

In 2004, when Renesas opened an office in Vietnam, there were few other technology companies in the country.

“It was a dream job for engineers like me,” Khoa recalls.

In the early 2000s, semiconductor was an emerging industry in Vietnam.

But people in the field understood the immense potential of the tiny devices.

The transistor, a semiconductor device small enough to be measured in nanometers, or a billionth of a meter, serves as an on-off “switch” for electronic devices and is among the most essential parts of phones, computers, refrigerators, and various other gadgets.

The arrival of Renesas in 2004 and Intel’s US$1 billion assembly and testing plant opening in 2006 were the catalysts that Vietnam needed to kickstart its semiconductor industry.

After the two giants made their entry, several other global semiconductor companies also opened offices in Vietnam and tied up with universities to set up training centers for workers in the industry, notably the Integrated Circuit Design Research and Education Center (ICDREC) at the Vietnam National University-HCMC in 2005.

“The [semiconductor] industry was as bustling back then as it is today,” Nguyen Thanh Yen, head of engineering at semiconductor manufacturer CoAsia Semi Vietnam and moderator of the Vietnam Microchip Community, a forum for semiconductor engineers, says.

The development of Vietnam’s semiconductor industry

After nearly 20 years since the first wave of semiconductor companies arrived, Vietnam is set for the next following the upgrade of its ties with the U.S., home to many of the world’s major high-tech companies, to a Comprehensive Strategic Partnership.

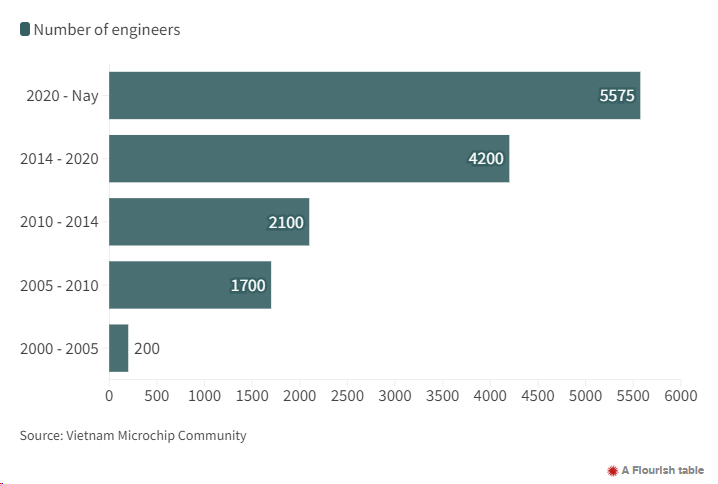

Vietnam has around 5,000 semiconductor engineers. With the world so focused on developing semiconductors, it will need at least 50,000, or 10 times the current number, by 2030 to secure a spot in the global supply chain, according to the Ministry of Information and Communications.

The first chips

Khoa, along with 19 other candidates, passed all of Renesas’ tests and became the firm’s first batch of Vietnamese engineers.

They were trained by Japanese experts for three months before being allowed to join any of the firm’s projects.

And it would be another half a decade before the group was tasked with designing its first chip, a car chip, one of Renesas’ key products.

“It was a glorious moment for us,” Khoa reminisces.

Engineers working at Renesas Vietnam in HCMC. Photo by VnExpress/Quynh Tran

Yen, who too joined the industry at around the same time as Khoa, says his first chip was a total failure.

He began working for chip design firm Active-Semi after graduating in 2004.

After a year of working and training, he designed his first product. But it failed to work, costing the company $200,000 and taking his team six months to discover the error.

Nine months later his second chip was a success, bringing massive sales to the firm and making up for his previous failure.

“Chipmaking is a stressful journey. It is not until our product is finished and functional without error that we can finally rejoice.”

A project can take years and hundreds of engineers to accomplish, but all it takes is a tiny error to bring all progress made by the team crashing down.

So design firms greatly value seasoned engineers with years of professional experience, Yen says.

But finding such people is not an easy task.

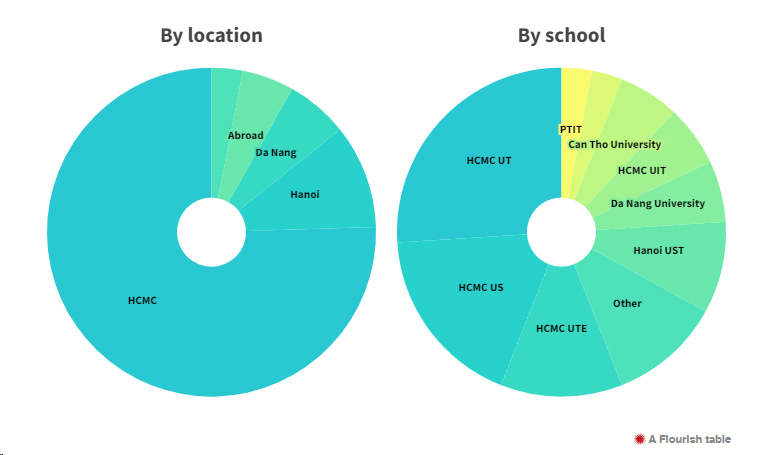

Khoa, now one of Renesas’ senior principal engineers, has been struggling for months to find experienced workers for the company’s upcoming projects despite HCMC being home to 75% of Vietnam’s microchip engineers.

“Fresh graduates do not have the experience required for highly advanced chips. But seasoned engineers are hard to find and companies compete intensely to recruit them.”

A slow journey

Having moderated the Vietnam Microchip Community for 10 years, Yen knows that most graduates require an additional three to six months of training at companies before they can participate in chip simulation and testing.

Only after two or three years of doing these jobs under the close supervision of experts can new engineers take part in the main steps of the chip design process.

“It takes several years to master each stage of the chip design process. Patience is required for people in this industry.”

This is a major factor that dissuades young people from pursuing a career in the semiconductor industry.

In contrast, software developers can become supervisors in two years and earn a lot more than semiconductor engineers in the same span of time, Yen says.

Assoc. Prof. Tran Xuan Tu, director of the Institute of Information Technology at the Vietnam National University-Hanoi, says semiconductor engineering used to be an unpopular course, and, before its recent boom began, there were 10 times more electronics and telecommunications engineering graduates.

There are no standardized training programs for semiconductor engineers and most are trained by companies, experts or training centers that offer certificate courses.

There is no infrastructure such as laboratories, equipment and tools for training them either, he says.

Vietnam semiconductor workforce

Purchasing licenses to use chip designing programs cost upwards of hundreds of thousands or even millions of dollars per year, far higher than the budget of any universities in Vietnam, he said.

With no access to modern tools, fresh graduates do not have the skills required by businesses and the lack of skilled workers deters foreign firms from investing in Vietnam.

This could leave the country stuck with packaging and testing that yield little value and unable to move up to higher-value jobs in the global supply chain.

Tu recalls that several famous chip manufacturers carried out site surveys in Hanoi a decade ago but ultimately decided against opening offices there because of the workforce shortage.

“With so few [semiconductor engineering] graduates being hired, of course universities did not want to invest in the major. This led to a vicious cycle that has existed for years.”

A chip designed by the Vietnam National University-HCMC on display at the Vietnam International Innovation Expo 2023. Photo by VnExpress/Luu Quy

With the infrastructure for education limited, semiconductor companies have to think of their own solutions.

Since entering Vietnam, Renesas has collaborated with several universities to develop courses in chip design and recruitment programs for graduating students.

With over 1,000 engineers, Vietnam now boasts its largest chip design center outside Japan.

Noriaki Sakamoto, president of Renesas Vietnam, believes the firm was right in investing in educating young engineers, saying Vietnamese workers are always industrious, persevering and eager and quick to learn and adopt new technologies.

Prof. Dang Luong Mo, a special consultant at the ICDREC, warns that the collaboration between universities and businesses focuses on short-term training courses, not enough to develop a semiconductor workforce in the long run.

Design is the stage that creates the most value in the chip supply chain.

It contributes 50-60% of the entire value with fabrication accounting for 30-40%, and packaging and testing for 10%.

It also requires less investment than other stages, which is why Vietnam decided to focus on it, Mo says.

But the country has not made significant progress towards developing a chip architecture based on which semiconductors can be designed to fit clients’ requirements, he says.

“If we only focus on the surface design processes without getting to the core of the chip, we will not create much value.”

But to have chief architects or chief chip designers, Vietnam needs to train more experts capable of in-depth research at postgraduate level, he concludes.

Semiconductor education workforce

Concurring with this, Sakamoto says too few Vietnamese engineers consider postgraduate programs.

Engineers in Japan need at least a master’s degree to work for Renesas’s chip design department, while only 10% of engineers at Renesas Vietnam have a postgraduate degree, he points out.

At a forum for technology firms last December, Trinh Khac Hue, director of multinational semiconductor firm Qorvo’s Vietnamese operations, said engineers in the country mostly worked on packaging and very few were capable of becoming chief designers.

Nonetheless, Vietnam could finally have a chance for a breakthrough after two decades of slow progress, he said.

Last year visiting American and Japanese semiconductor executives expressed willingness to collaborate with and assist Vietnam in making chips.

In the first half alone there were visits by John Neffeur, president of the Semiconductor Industry Association which represents the industry in the U.S., and Jensen Huang, CEO of Nvidia, the largest chipmaker in the world in terms of market capitalization, and both said the country’s semiconductor industry had immense potential for development.

“Now that there is a global shortage of chip workers, firms are finally taking a second look at Vietnam,” Tu says.

The chipmaking race

Other Southeast Asian countries like Malaysia, Thailand and the Philippines are also investing heavily in the semiconductor industry.

“To surpass them, Vietnam must find a way to speed up progress,” Mo says, pointing out that Vietnamese universities are way below their regional peers in global rankings lists.

To get the number of semiconductor engineers to 50,000, a 10-fold increase from the current number, is a formidable but not insurmountable challenge, according to experts and regulators.

According to Minister of Education Nguyen Kim Son, 35 universities in Vietnam offer courses in semiconductor fabrication.

In 2025 each of them will take in 1,000 students in their chip design courses and 7,000 in related courses, and these numbers are expected to increase by 20-30% a year, he says.

Chips designed by engineers at Qorvo Vietnam on display at the Vietnam International Innovation Expo 2023. Photo by VnExpress/Luu Quy

Tu of the Institute of Information Technology says fresh graduates in electronics, computer technology, physics, mathematics, and informatics can also work in semiconductor technology and chip design after doing a three- to six-month course.

So the government can consider converting 20,000-30,000 engineers in IT, electronics and telecommunications into semiconductor engineers, he suggests.

But Tu calls for precision. In chip design, each job has its own requirements and each stage has its specialized software, he explains.

Nurturing a chief designer with a deep understanding of chip architecture is a lengthy and complex process, and the government should designate one university to coordinate semiconductor training across the country, he says.

Each university can develop a specialized training program for each stage of the chipmaking process, and the coordinating school can establish a facility with modern equipment and tools for sharing by all the universities, he says.

“Investing in training programs for semiconductor manufacturing is extremely costly and complex, especially for the fabrication process. Hence, the capital should not be spread too thin, which will be the case if the schools are left to their own devices.”

Sakamoto wants the government to provide more grants to facilitate cooperation between businesses and universities.

“Vietnam having plenty of excellent students proficient in chip designing will also save us [businesses] time and training costs when recruiting.”

Even veteran engineers with nearly 20 years of experience like Khoa have to be on their toes to keep pace with new technologies.

Vietnamese engineers are present in the creation of most of Renesas’ new technology products.

Besides, they recently adopted artificial intelligence in production to speed up testing in the design stage by 30%.

Renesas’s parent company introduced this advancement to its other design centers around the world.

Khoa and his colleagues began from scratch and have been working in the field for nearly two decades, achieving numerous milestones and harboring an ever-growing ambition to help Vietnam craft its own chip production line.

“In the next few years I have no doubt Vietnamese engineers will be able to develop a chip’s core technology – its architecture,” Khoa adds confidently.

Story by Viet Duc, Luu Quy

Graphics by Dang Hieu, Khanh Hoang

(Source: e.vnexpress.net)