The stock market might recover this year while the real estate, gold and cryptocurrency markets face uncertainties, experts forecast.

An employee counts Vietnamese banknotes at a bank in Hanoi. Photo by VnExpress/Giang Huy

Bank deposit interest rates to stay low

At the end of 2023 bank deposits increased by 14% to an all-time high of VND13.5 quadrillion (US$550.12 billion).

Now most banks have reduced their deposit interest rates to less than 5% for periods of up to 12 months.

The relentless inflow into banks despite the huge interest rate cuts is concerning since it means capital is not flowing into production and investment, according to the deputy director of a state-owned bank.

The consensus among analysts and bank executives is that deposit interest rates will stay low at least until mid-2024, after which there may be a slight increase as credit demand rises.

But they are unlikely to return to the high levels of recent years.

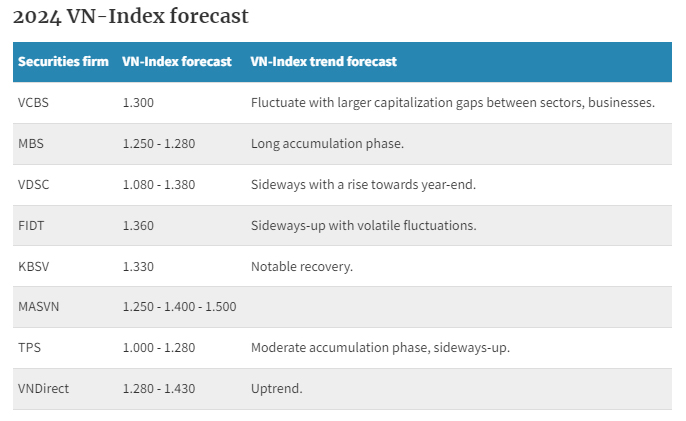

Low deposit rates might boost VN-Index

Securities firms and analysts expect the VN-Index to rise this year due to the low deposit interest rates and more optimistic profit forecasts by businesses, with the former factor seen as more influential.

Vietcombank Securities expects the fall in interest rates, which are even lower than during Covid-19 times, to boost the stock market in 2024.

The U.S. is almost done tightening monetary policies and is waiting for the right timing to cut interest rates, it said.

Once this happens the currency exchange rate pressure would ease for Vietnam and its central bank would have more room to loosen monetary policy, it added.

Securities firm Mirae Asset Vietnam expects investment, production and consumption to recover this year, increasing earnings in most sectors.

But it noted that most listed companies have significantly lower earnings per share than before the pandemic and are less resilient to global headwinds and huge changes.

Investing in gold becomes riskier

Saigon Jewelry Company (SJC) gold bar prices rose 20% and hit an all-time high of VND80 million per tael (37.5 gm) in 2023.

They have now stabilized at VND78-79 million.

Analysts expect the precious metal to gain since the U.S. central bank has indicated it will cut interest rates three times this year.

Lower rates will weaken the dollar and reduce U.S. Treasury bond yields while bolstering the value of gold.

SJC gold pricesVND million per tael (VND1 million = $40.75)3-1-2024● Price: 75.5

However, SJC gold bars face risks from domestic policy changes.

The State Bank of Vietnam recently called on the government to make policy changes including abolishing the SJC’s monopoly on gold bullion.

A deputy director of a state-owned bank said should the central bank increase supply or the SJC loses its monopoly, the price gap between gold bars and other types of gold in the market would be much narrower than the current tens of millions of dong.

People who bought bullion before prices drop would suffer severe losses, she pointed out.

Another bank executive said: “Gold bars are not a good choice for retail investors, especially during periods of rapid price changes. Furthermore, supply is difficult to forecast, which poses a risk to investors.”

Huynh Trung Khanh, vice president of the Vietnam Gold Traders Association, said bullion is more volatile and riskier than other types of gold.

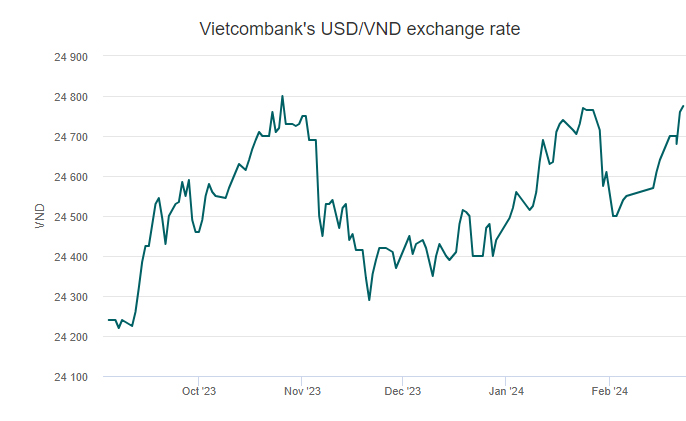

Dollar less profitable than other asset classes

Investing in the dollar often yields lower profits than other investments.

It yields average profits of 3-5% a year depending on the dollar-dong exchange rate movements.

With the central bank’s dedollarization and flexible exchange rate policies, investment in the dollar could yield even less returns than a bank savings account.

VNDVietcombank’s USD/VND exchange rateOct ’23Nov ’23Dec ’23Jan ’24Feb ‘2424 10024 20024 30024 40024 50024 60024 70024 80024 900

Dinh Duc Quang, country head of global markets at United Overseas Bank Vietnam (UOB), said the low dong deposit and interbank interest rates would affect banks’ short-term forex plans.

UOB expects the dollar to only depreciate slightly when the U.S. cuts interest rates in the second half of the year.

Housing market may see more demand

Since the beginning of the year property developers have been focusing on selling their products.

Homebuyers are gradually becoming interested in the market again thanks to the low interest rates and policies to stimulate demand.

Developers are offering various promotions, discounts and increasingly flexible payment plans.

In a recent analysis, investment fund VinaCapital said the real estate market is beginning to recover as evidenced by the absorption rates of over 80% at some projects developed by large companies in prime locations.

The government is determined to address issues plaguing the market as revenues from land-use fees are expected to increase by 70% in 2024, it noted.

Housing projects in major urban centers have seen large demand from actual users rather than speculators or investors, according to Tran Khanh Quang, CEO of property developer Viet An Hoa.

The segment would continue to attract more developers, he said.

Most factors necessary for the real estate market’s recovery are in place, and the only remaining issue is that legal hurdles have not been resolved despite new regulations, he said.

“I hope that by the second quarter, the remaining legal issues will be resolved to improve sentiments and draw capital into the market.”

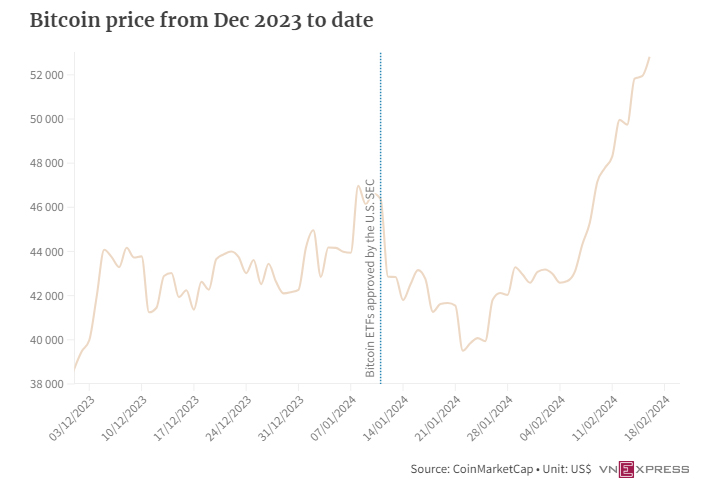

The cryptocurrency winter may be over

With Bitcoin surpassing $50,000 last week for the first time in more than two years, the market has warmed up significantly since last year, according to Le Sy Nguyen, ASEAN regional manager of crypto exchange Bybit.

In addition to price gains, the cryptocurrency market has also seen many new projects launched, attracting new investors and steadily increasing the market capitalization.

Market observers expect cryptocurrencies to rebound this year thanks to two factors: the Bitcoin halving event and capital inflows from Bitcoin ETFs.

Halving is an event that occurs every four years where the reward for Bitcoin mining is cut by half.

It helps lower inflation by reducing the number of new Bitcoins created. Lender Standard Chartered has forecast Bitcoin to reach $100,000 this year due to these factors.

Nevertheless, Nguyen said, investors should be cautious when entering the cryptocurrency market. “The advice for investors in the new year is to invest in what they truly understand.”

Quynh Trang, Tat Dat (Source: e.vnexpress.net)