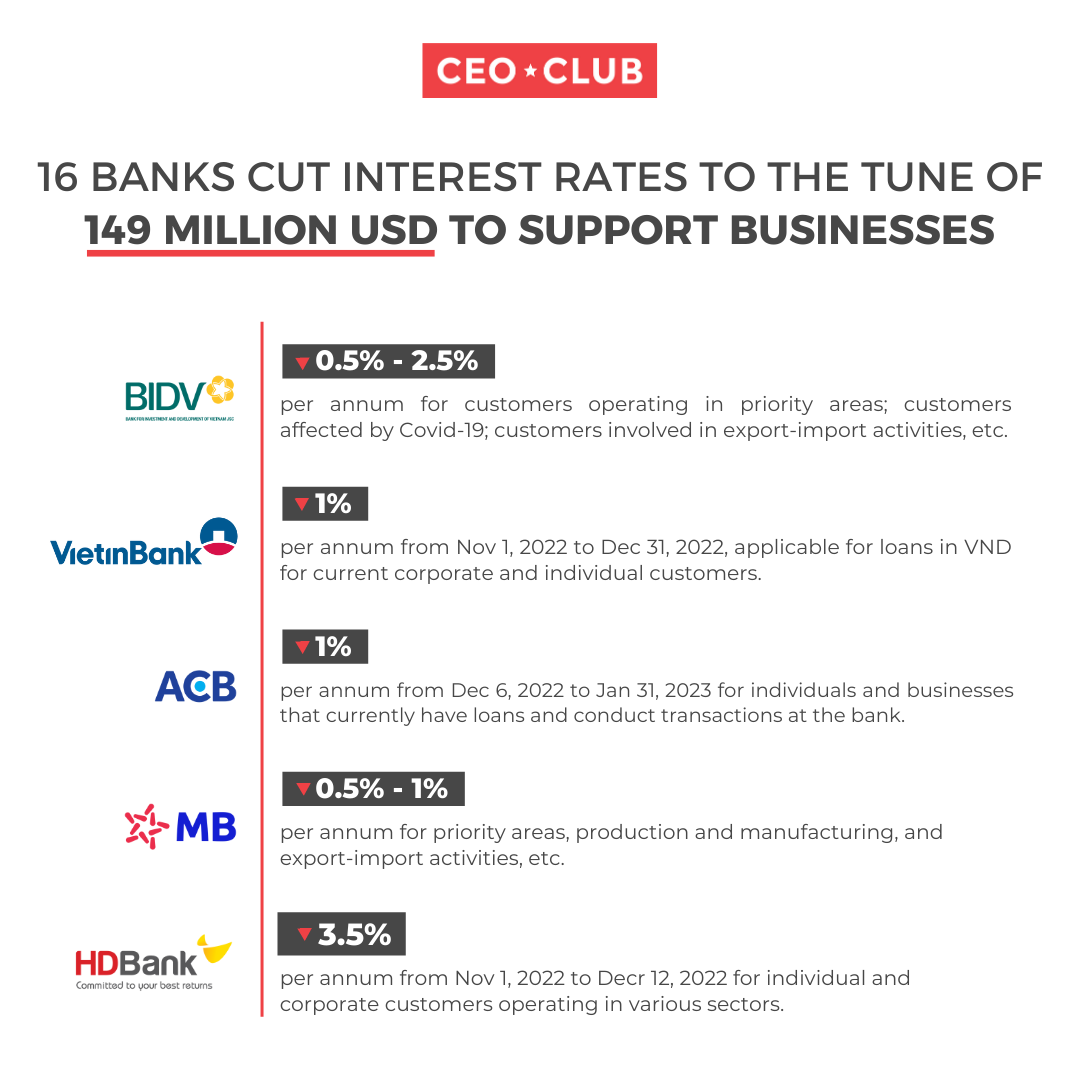

The commercial banks committed to a reduction in loan rates of between 0.5 and 3 per cent per annum.

Sixteen commercial banks have committed to reducing interest rates totaling some VND3.5 trillion ($149 million), with lending rates falling by between 0.5 and 3 per cent per annum, according to the Vietnam Banks Association

BIDV cut its loan rate by 0.5-2.5 per cent per annum for customers operating in priority areas; customers affected by Covid-19; customers involved in export-import activities; foreign enterprises; and individuals, etc.

Vietcombank reduced interest rates by 1 per cent per annum from November 1, 2022 to December 31, 2022, applicable for loans in VND for current corporate and individual customers. It is estimated that 175,000 customers will enjoy rate reductions on credit loans totaling VND500 trillion ($21 billion), or 50 per cent of its total current credit debt.

ACB has cut its loan interest rate by 1 per cent per annum from December 6, 2022 to January 31, 2023 for individuals and businesses that currently have loans and conduct transactions at the bank.

MB offers a separate preferential package, reducing loan interest rates by 0.5-1 per cent per annum for priority areas, production and manufacturing, and export-import activities, etc.

HDBank has announced cuts to lending interest rates of 3.5 per cent per annum, with the total reductions totaling up to VND120 billion ($5 million) from November 1, 2022 to December 12, 2022 for individual and corporate customers operating in various sectors.

Source: VnEconomy

Dec 16, 2022